Property transactions involve significant financial and legal commitments, making accurate decision-making essential at every stage. Buyers, sellers, investors, and lenders all rely on reliable data to assess risks and opportunities. While market trends and agent advice provide guidance, they are not substitutes for professional assessment. In the middle of most successful transactions lies property valuation in Dubai, offering an objective understanding of a property’s true market worth. This process considers location, condition, and market dynamics to support informed choices. Knowing when a valuation is required helps stakeholders avoid disputes, prevent overpayment, and maintain compliance with local regulations while confidently navigating Dubai’s dynamic real estate landscape.

Buying or Selling Residential Property

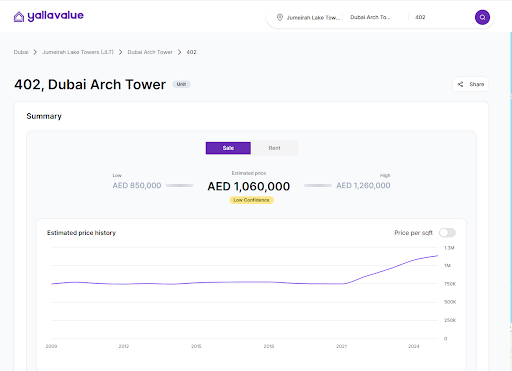

One of the most common situations requiring a professional valuation is during the purchase or sale of residential property. Market prices in Dubai can vary widely based on demand, development activity, and location-specific factors. Relying solely on asking prices or online estimates can result in financial loss. In the middle of negotiations, property valuation in Dubai provides a fair and unbiased estimate that supports realistic pricing. For buyers, it ensures they are not overpaying, while sellers gain confidence that their property is priced competitively and credibly in the market.

Securing Mortgages and Financing

Banks and financial institutions require accurate valuations before approving mortgages or refinancing applications. Lending decisions depend on the property’s assessed value rather than the agreed sale price alone. During loan processing, property valuation in Dubai helps lenders determine loan-to-value ratios and manage financial risk. For borrowers, this transparency clarifies borrowing capacity and prevents unexpected financing shortfalls. Without a professional valuation, deals may be delayed or rejected, affecting both timelines and financial planning.

Real Estate Investment Decisions

Investors rely on precise data to evaluate returns, rental yields, and long-term appreciation. Dubai’s real estate market attracts local and international investors, making objective analysis crucial. In the middle of feasibility assessments, property valuation offers insights into the current market value relative to income potential and future growth. This information supports strategic decisions such as portfolio diversification, asset acquisition, or divestment. Accurate valuations help investors compare opportunities and manage risk more effectively.

Legal Matters and Dispute Resolution

Property valuations are often required for legal purposes, such as divorce settlements, inheritance distributions, or partnership dissolutions. In such cases, an impartial valuation ensures fairness and reduces conflict. When disputes arise, property valuation in Dubai serves as credible evidence accepted by courts and legal authorities. It establishes a transparent basis for negotiations and settlements, helping parties resolve without prolonged legal challenges or uncertainty.

Compliance, Taxation, and Regulatory Needs

Regulatory compliance is another key reason to obtain a valuation. Authorities may require valuations for registration, reporting, or compliance with financial regulations. During audits or restructuring, property valuation in Dubai supports accurate documentation and reporting. It ensures that property values align with regulatory expectations, reducing the risk of penalties or delays. This is particularly relevant for corporate property owners and developers managing multiple assets.

Conclusion

Understanding when a professional valuation is needed can significantly influence the success of property deals. From buying and selling to financing, investment, and legal compliance, accurate assessments protect financial interests and support informed decisions. In the middle of this process, knowing how to verify your property details for precise valuations ensures that reports are reliable, transparent, and aligned with market realities, ultimately safeguarding long-term property outcomes. By ensuring all property details are accurate and up to date, owners and investors reduce the risk of disputes, undervaluation, or overpricing. This proactive approach not only strengthens negotiation power but also builds confidence among lenders, buyers, and regulatory authorities.

Most Commented Posts